2011年1月19日

日本船主協会

FMCのEU競争法適用除外制度廃止影響調査に関する当協会コメントの提出について

米国連邦海事委員会(FMC)は、EUの定期船同盟に対する競争法適用除外制度を規定した規則4056/86の廃止(2008年10月)が米国・欧州航路やアジア・欧州航路等の主要航路の構造および運賃・サーチャージ等に与えた影響について、2006年1月から2010年末までの5年間を対象期間とする調査を行なっております(本調査結果は2011年秋に完成予定)。

FMCは2010年11月、規則4056/86廃止の影響に関する質問通知(Notice of Inquiry)を公表し、関係者に対し、2011年1月18日を期限に本調査に関する情報提供を求めたことから、当協会は昨18日付で以下コメントを提出しましたので、概要を添えてお知らせいたします。

以上

EU の定期船同盟に対する競争法適用除外制度廃止の影響について、日本船主協会は米国連邦海事委員会(FMC)に対し、以下コメントを提出する。

1.船社間協定に対する競争法適用除外に関する当協会の基本的な見解

船社間協定は運賃の安定性に寄与しており、その結果、船社間協定加盟船社は信頼性のある定期船サービスを提供し、サービスの質および効率性の向上を行う上でかなりの費用を節約できる。

当協会は、船社間協定に対する競争法適用除外制度(以下「適用除外制度」)が外航海運業界や貿易業界全体の健全な発展に不可欠であると考える。適用除外制度は、実質的に全ての主要貿易国で認められており、国際的にも一般的な制度となっている。

2.EUの適用除外制度廃止

EUが適用除外制度を廃止した2008年10月は、定期船業界が世界的な景気悪化の中で貨物量および運賃の著しい下落に直面していた時期であったため、その様な状況の下で、EUの適用除外制度廃止による影響を評価するのは困難である。

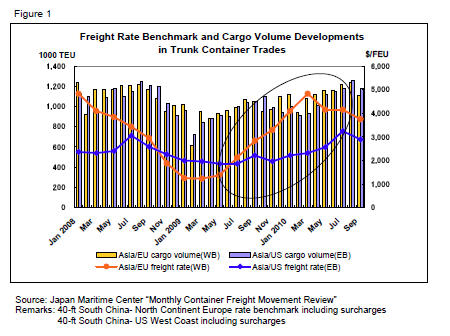

但し、2008年1月から2010年10月までの東西基幹航路の運賃推移をみると(当協会意見書の表1参照)、同期間中の両航路の荷動き推移は同様の傾向にあったにもかかわらず、アジア・欧州航路(西航)の運賃乱高下はアジア・北米航路(東航)を大きく上回っていることが少なくとも確認できる。また、欧州委員会はEUの適用除外制度見直しの過程の中で、同制度廃止が輸送コストを低下させる利用可能な最善の選択肢と主張していたが、2009年春以降の欧州航路の急激な運賃上昇を踏まえると、そのような見解は適切ではないように思われる。

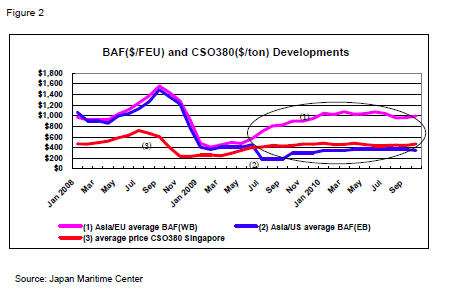

さらに、サーチャージでは、欧州諸港のTHC(Terminal Handling Charges)がEUの適用除外制度廃止に伴い概ね上昇し、また、BAF(Bunker Adjustment Factors)についても、燃料油価格の上昇時には、北米航路のBAFよりも個別船社による設定が行われる欧州航路のBAFの方が上昇傾向にあることを踏まえれば(同意見書の表2参照)、適用除外制度の廃止は必ずしもサーチャージの値下げや顧客利益に貢献していないことがわかる。

3.結び

当協会は、EUの適用除外制度廃止が主要航路に与える影響について慎重に評価するFMCの実際的なアプローチ(pragmatic approach)を歓迎するものである。

当協会は、船社間協定廃止が一層の運賃乱高下と市場の不安定をもたらし、それは荷主、最終的には消費者の利益にもならないとの見解である一方、EUの適用除外制度廃止が世界同時不況の時期と重なっていることを踏まえ、FMCに対しては、外航海運に関する米国現行制度の変更に関する検討を行う前に、EUの適用除外制度廃止の影響について更なる調査を今後も行っていくべきとの考えである。

以上

18 January 2011

Comments of the Japanese Shipowners' Association

On the Notice of Inquiry of the Federal Maritime Commission

Concerning the European Union's Repeal of the Liner Conference Block Exemption

The Japanese Shipowners’ Association (JSA), which is a nationwide shipowners'association consisting of 101 Japanese shipping companies, appreciates this pportunity to respectfully submit to the Federal Maritime Commission (FMC) the following comments, which, we believe, are in line with the intention of the Notice of Inquiry (NOI) issued on 1 November 2010 concerning the effect on international liner shipping of the European Union's (EU) repeal of the liner block exemption from competition laws.

1) JSA's fundamental stance on the antitrust immunity for carrier agreements

The liner shipping industry, which provides regular ocean transportation service to hundreds of ports worldwide, has developed largely because of the carriers’ ability to participate in cooperative commercial arrangements dating back over 100 years. These arrangements have contributed to stable freight rates and, as a result, enabled participating shipping companies of carrier agreements such as conferences, discussion agreements and consortia to save significant costs in providing reliable liner shipping services and improve their service quality and efficiency. The JSA believes that the antitrust immunity for carrier agreements (hereafter referred to as the "immunity system") is indispensable for the healthy development of the international shipping industry, as well as the whole international trading industry. The immunity system is the international regulatory norm, as it is permitted in virtually all major trading nations around the world. We therefore fully support the recent decision in Singapore to extend its current immunity system through the end of 2015 without any significant changes to its scope1.

1 http://app.ccs.gov.sg/PC_Archived_BEO.aspx

2) The EU's repeal of the liner block exemption

At the time of the repeal of the block exemption in the EU in October 2008, the whole container shipping industry was in a global economic downturn, which has been described as a once-in-a-century recession. During this time, the shipping industry has faced a considerable decline in cargo volumes and rates with operating losses of more than 15 billion dollars in 2009. It is therefore difficult to assess what changes in the industry during the period were attributable to the EU’s repeal of the block exemption under such severe economic conditions.

However, it can be at least confirmed from Figure 1 below that the rate volatility of the Asia-EU trade greatly exceeds that of the Asia-US trade, which maintains immunity systems in both port-end countries despite the similar trends in the container cargo movements in both trades. In light of the sharp increase in freight rates in the Asia-EU trade after recording the lowest rate in the spring of 2009, such a view, that the repeal of the conference block exemption is the best available option to lower transport costs, which was argued by the European Commission in the process of reviewing the EU's block exemption2, does not seem applicable.

There have also been differences in ancillary charges prior to and after the abolition of the block exemption in the EU. For instance, the Terminal Handling Charge (THC), which has remained virtually unchanged for nearly 15 years in Europe, has recently increased in most European ports around the same time as the repeal as reported in a competition report3 which was produced for the European Commission in October 2009.

Furthermore, with respect to the Bunker Adjustment Factor (BAF) as well, we can see different developments in both trades as shown in Figure 2 below. The price of marine fuel, which is mainly CSO 380, reached a record level of more than $750 per tonne in the summer of 2008, and they still stand at a high level of almost $500 per tonne. The full cost recovery by imposing the BAF on customers with a minimal delay is indispensable for ocean carriers. Each carrier sets up its own BAFs in the Asia-Europe trade on an independent basis in the same way as in the case of THCs, while the TSA4 publishes non-binding guidelines for BAFs with a transparent calculation formula5 in the Asia-US trade. As a result, it may be said that the average BAF in the Asia/EU trade increases more than that of the Asia-US trade in the case of an increase in marine fuel prices.

2 SEC(2005) 1641 COMMISSION OF THE EUROPEAN COMMUNITIES

3“Terminal handling charges during and after the liner conference era”

http://ec.europa.eu/competition/sectors/transport/reports/terminal_handling_charges.pdf

4 Transpacific Stabilization Agreement

5 http://www.tsacarriers.org/fs_bunker.html

3) Conclusion

The JSA welcomes the pragmatic approach of the FMC to carefully assess the effects of the EU’s repeal of the block exemption on the various elements of transport services in trunk lanes. For the foregoing reasons, the JSA is of the view that the repeal of carrier agreements would lead to greater rate volatility and less stable markets, which is not likely to be in the interests of shippers, and eventually consumers, as well. However, in light of the fact that the abolition of the block exemption in the EU coincided with the severe global economic downturn, the JSA believes the FMC should continue to further study its effects before considering any change in action to change the current ocean regulatory system in the US.